What a comfortable income looks like in Canada, according to a new survey

For many Canadians, an annual household income of $100,000 is necessary to feel comfortable, according to a new survey.

However, the amount required to feel at ease differs depending on age, the size of a given household, whether they own their home and where they live.

In June, Canadian magazine, MoneySense , teamed up with Leger Marketing research to survey more than 9,000 Canadians living in 79 different Canadian cities. The survey canvassed five income options between $74,200 up to $250,000.

$100,000 was the most popular option, chosen by 37 per cent of survey respondents. The next biggest group, 25.8 per cent, chose $150,000. Somewhat fewer respondents, 23.8 per cent, chose $74,200. Much smaller groups opted for the higher options of $200,000 (8.5 per cent) and $250,000 (4.9 per cent).

According to Statistics Canada , $100,702 was the average disposable income for Canadian households in 2024.

Looking to individual incomes, the top 10 per cent earners in Canada earn at least $125,945 annually. To be in the top 25 per cent, the amount to reach is $81,184. Individual Canadians earning between $57,375 and $114,750 are considered middle-class.

How does the cost of living impact income comfort?The adequacy of income is linked to the cost of living, which changes over time. For example, $100 in 2020 is equivalent to $118.14 today. In other words, it would take $118.14 to buy the same goods/services today that took $100 in 2020. But Canadians whose wages have risen accordingly should fare better.

Canada’s major banks look at “affordability” based on the rule that average shelter costs should not exceed 30 per cent of gross household income .

However, there are additional measures of affordability such as transportation, food, utilities, clothing and leisure. CareerBeacon looks at affordability based on those measures, as well as renting rather than owning a home. It looked at Canadian cities with populations of 50,000 or more and looked at the annual income required for an individual to be comfortable in each.

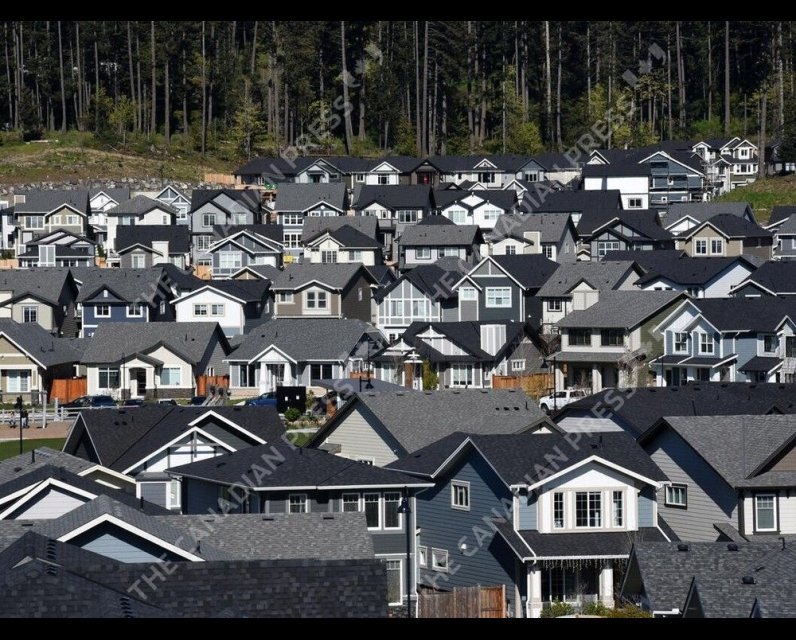

The results vary from about $58,000 to over $106,000. Perhaps predictably, the most expensive cities are set near major job centres such as Toronto and Vancouver, while more affordable cities are outside large metro areas and have lower housing demand.

The cities requiring the highest incomes to feel financially comfortable are:

Richmond Hill, ON – $106,536 Milton, ON – $106,392 Whitby, ON – $105,624 Coquitlam, BC – $104,928 North Vancouver, BC – $103,512

The cities where comfort comes with a lower income are:

Trois-Rivières, QC – $57,936 Sherbrooke, QC – $64,920 Medicine Hat, AB – $70,416 Fredericton, NB – $71,784 Sault Ste. Marie, ON – $72,744

How does inflation affect the buying power of income?The adequacy of income fluctuate s with inflation. Statistics Canada tracks inflation by keeping tabs on the prices of a so-called “basket” of goods and services. The prices of these items add up to an average known as the consumer price index , or CPI.

Inflation was close to 2 per cent per year for 25 years – until COVID-19 hit. In 2022, inflation surged above 8 per cent – the highest since the 1980s. Then when the economy reopened, Canadian demand for goods and services surged, hindered by supply chain disruptions that drove prices higher and left many Canadians struggling.

In 2022, the Bank of Canada began an aggressive campaign to tame inflation, with 10 interest rate increases in less than two years. It worked.

How have annual incomes in Canada kept up with inflation – or not?Still, the news still hasn’t been good for all Canadians, especially with regard to increasing income to deal with increased cost of living.

Wages increased amid the higher-income brackets, with those Canadians often coming out last five years with bigger investment portfolios boosted by the higher interest rates. (When interest rates rise, most stock prices tend to fall, making them more affordable.)

“Based on our analysis, the price of the basket of goods and services has increased by 15 per cent since 2019, but disposable income has increased by 21 per cent, supported by government transfers, wage gains and net investment income, thereby improving the purchasing power of most Canadian households,” said Parliamentary Budget Officer Yves Giroux in a 2024 press release.

However, he conceded that “since 2022 rising inflation and tighter monetary policy have reduced purchasing power for lower-income households.”

Our website is the place for the latest breaking news, exclusive scoops, longreads and provocative commentary. Please bookmark nationalpost.com and sign up for our daily newsletter, Posted, here.

Comments

Be the first to comment