Climate policies, AI demand and tariffs collide as U.S. electric bills soar

WASHINGTON, D.C. — As temperatures drop and golden leaves cover lawns throughout Canada and the northern United States, residents are starting to turn on the heat. Earlier this year, amid President Donald Trump’s trade war, it appeared that energy tariffs might be used as a weapon, potentially driving up electricity prices for U.S. and Canadian consumers alike.

Canadian energy prices have risen moderately, largely due to inflation and infrastructure upgrades. But with autumn in full swing and winter looming, Americans are being warned that electricity prices are set to soar, and not for the usual reasons like oil or natural gas spikes. Instead, a combination of factors — everything from weather and rising demand to climate change policies and tariffs — is contributing to the increases, and experts see no relief in sight.

Electricity rates in the U.S. are up 9.7 per cent since January and, according to the National Energy Assistance Directors Association (NEADA) in Washington, D.C., home heating prices over the coming months are set to rise by 7.6 per cent compared to last year.

“That’s a lot,” said Mark Wolfe, executive director of NEADA. “We’re not used to rates going up like that,” he added, emphasizing that electricity prices tend to go up and rarely go down.

Some regions have been hit harder than others. In 10 states — Illinois, Indiana, Ohio, Iowa, Massachusetts, New Jersey, Pennsylvania, Michigan, Wisconsin, Minnesota — plus the District of Columbia, for example, electric bills rose more than 15 per cent between July 2024 and July 2025, according to NEADA.

While the entire country is expected to feel the pinch this winter, the highest price increases, according to Gary Hufbauer, a non-resident senior fellow at the D.C.-based Peterson Institute for International Economics, will hit the Atlantic, Mid-Atlantic, New England, Michigan, and Wisconsin.

In New England, things are already tough. “We have the highest residential electricity rates in the nation, except for Alaska and Hawaii,” John Howat, senior energy analyst at the Boston-based National Consumer Law Center, explained. “Our electricity rates are 41 per cent higher than the national average.”

Electricity is the biggest driver of rising bills, while natural gas prices remain flat and propane and heating oil costs are expected to fall, Howat said. However, natural gas prices are known to fluctuate.

The average American family spends three or four per cent of their income on home energy, but that goes up to eight or nine per cent for low-income families. As a result, past-due balances are on the rise, and this comes at a time when assistance programmes are at risk as long as the U.S. government remains shut down.

“I can tell you, as a consumer advocate, that home energy expenditures – it’s sort of like the new price of eggs. People are really struggling,” Howat said.

So what’s causing the price surge? Many things, experts say, but one of the main drivers is electricity demand. “We’re seeing rising electric prices and rising demand,” said Wolfe.

The International Energy Agency has said U.S. electricity demand hit a new record in 2024 at about 2 per cent, and that rate of growth is expected to continue through 2027.

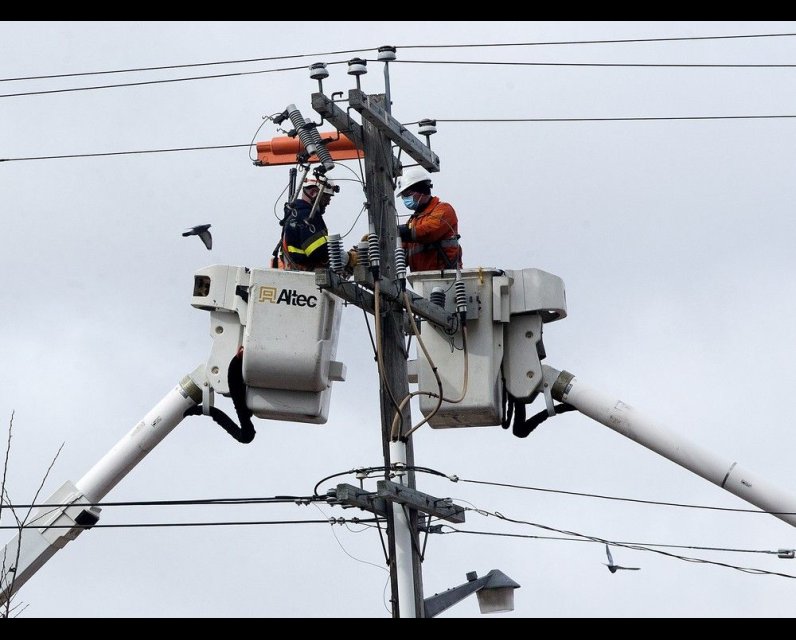

Beyond demand, which also demands upgrades, grid rebuilding and modernization efforts are putting upward pressure on costs.

“As far as I can tell, the electricity price increases are all ultimately climate-related,” said Howat, pointing to capital investment costs in states committed to climate change policies and costs for upgrading to ensure resiliency in states less committed to mitigating climate change.

“Utilities had neglected the reliability of the grid for a long time,” said Wolfe. “Now it’s catching up.”

In Massachusetts, for example, a lot of the price rise “is primarily to fund climate change activities,” said Michael Ferrante, president of the Massachusetts Energy Marketers Association. “We have a very expensive equipment upgrade programme called Mass Save … and consumers pay for that.”

Unsurprisingly, experts point fingers at AI data centres for causing much of the unexpected demand on the grid, and they note that debates continue over how much of the price burden these facilities should bear.

“Data centres are not paying their fair share of the costs, but states want to attract them — they’re economic development engines,” said Wolfe. “That’s the tension we’re hearing.”

Weather, of course, is also a top factor — the colder the winter, the higher the bills.

But trade tensions between the U.S. and Canada are also having an impact, albeit a less direct one.

“Hydroelectric tariffs are not helping matters,” said Howat, referring to the 10 per cent tariff on Canadian hydro. In New England, over five per cent of the resource need is met through Canadian hydro, and that can jump to over 10 per cent during peak winter periods. “With the tariffs, that can only put upward pressure on prices,” he added.

Tariffs on crude oil and natural gas are notably mitigated by compliance with CUSMA, but there are other tariffs having an impact on the U.S. electricity grid.

Imported energy equipment, including power plant components, steel, copper, and aluminum, faces high tariffs ranging from 25 to 50 per cent, and they are critical components for all the infrastructural upgrades and expansions.

“I don’t think (the tariffs have) had much effect yet,” said Hufbauer, “but they certainly will in time because it really boosted the price of these key ingredients of your electricity infrastructure.”

Overall, the picture for affordable U.S. energy is bleak.

“Electricity is becoming less and less affordable in the United States,” Wolfe warned. “We should view last year’s data as a wake-up call.”

National Post

Our website is the place for the latest breaking news, exclusive scoops, longreads and provocative commentary. Please bookmark nationalpost.com and sign up for our newsletters here.

Comments

Be the first to comment