Campaign Letter

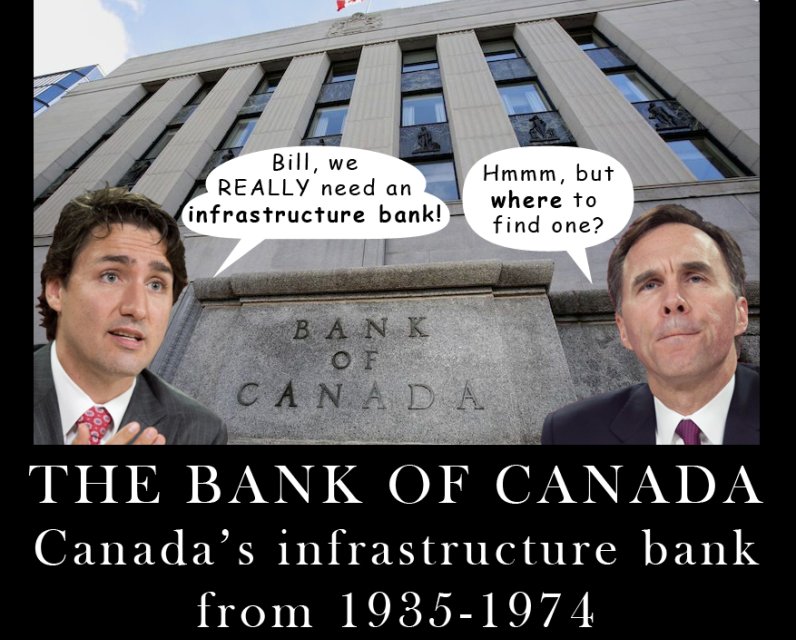

Bank of Canada vs. Canadian Infrastructure Bank

TO:

The Right Honourable Justin Trudeau, P.C., M.P., Prime Minister of Canada

The Honourable Bill Morneau, P.C., Minister of Finance

Mr. Nathaniel Erskine-Smith, M.P., House of Commons

Dear Prime Minister, Minister, and Mr. Erskine-Smith,

Last year an e-petition was submitted to the government requesting the Bank of Canada fulfill its stated role "to promote the economic and financial welfare of Canada", by returning to previous levels of monetary financing and economic activity[i], as opposed to only focusing on inflation through the blunt and indirect instrument of influencing short-term interest rates in overnight markets.

Minister Morneau's response to the petition was troubling, as it cites disproven assumptions about inflation that Canada's own history belies. Empirical evidence shows higher levels of federal monetary financing did not affect inflation in Canada[ii], the most recent proof being when Harper increased the monetary financing of the BoC 33% for three years in 2011[iii] and inflation actually decreased[iv]. Careful analyses of instances of hyperinflation by institutions like the IMF have proven public money creation alone is never the culprit, but rather speculation, corruption, a poor understanding of monetary policy and economics, and market forces are of greater influence[v].

Claiming government monetary financing is inflationary ignores that private bank money creation dwarfs government money creation at approximately 97%[vi] of our money supply created as debt with interest attached[vii]. It is their loans and credit that have caused consumer debt rise to nearly 170% of average income and over 100% of GDP[viii], while also inflating asset prices resulting in the soaring housing prices in Toronto and Vancouver[ix]. The elimination of reserve requirements at the BoC in 1991, replaced by the amorphous and ephemeral capital requirements, ensured what little direct control over the money supply the BoC had was gone[x]. Also disproving the notion is that the massive amounts of QE injected into various economies after the ‘08 crisis were not inflationary to consumer prices either (although it did inflate asset prices)[xi].

However, the most alarmingly ironic statements come from our current BoC governor Mr. Poloz[xii]. In selling the notion that a nation with a public central bank counter-intuitively needs foreign investment to fund public infrastructure, he then lists two projects, the St. Lawrence Seaway and the Trans-Canada Highway, which required no foreign investment whatsoever and were primarily funded through monetary financing using the Bank of Canada. The St. Lawrence Seaway did not need US investment, in fact, after the US dragged its heels for too long Canada threatened to go it alone[xiii], and the US finally got involved because it would not have a claim to any revenues if they didn’t share the cost. Either Mr. Poloz is intentionally misleading the public on this history, or he is unaware of the history of the institution he is leading.

The two most economically beneficial banks in the history of Canada are the Bank of Canada and the Industrial Development Bank (now the BDC). Both had the same auspicious beginnings with a capitalization injection of publicly created funds[xiv]. At the same time the BoC was nationalized in 1938, the government enacted Bill 143, the Municipal Improvements Assistance Act, which allowed municipalities to borrow directly from the federal government for building municipal infrastructure[xv]. The Bank of Canada was once the largest holder of federal debt, using monetary financing to bring us into the unprecedented growth of our golden years in the post-war period, funding many important public infrastructure projects like the St. Lawrence Seaway, Trans Canada Highway, and early parts of the 401 Highway. More importantly, we had no problem using the BoC to fund our efforts in WWII[xvi], but somehow we can’t use it for peaceful purposes? As we did until we joined the Bank for International Settlements’ first Basel Committee in 1974[xvii] and proceeded to adopt monetarism, the now disproven notion that the money supply is the main driver of inflation[xviii]. The resulting increase in federal debt after 1974 is painfully clear[xix], and was a direct and immediate result of these policy changes. The following year the government rescinded Bill 143 in line with the dictates of the BIS. Monetarism forced increased private sector borrowing instead of public money creation, and since then the federal share of the total public debt burden has shifted onto municipalities[xx] and is set to further burden cities now that the 2017 budget has reduced their access to federal funding[xxi].

Let's say the government needs to build $1 billion in new infrastructure. It can either:

- create the money with the Bank of Canada

OR

- borrow the funds selling bonds in capital markets

Either way, $1 billion is spent on public goods, it will have the same result economically and socially and create the exact same number of jobs and result in the same physical asset[xxii], it's just in the latter option it needs to be paid back with interest.

It is most worrying to hear Prime Minister Trudeau speak to business audiences wooing them with promises of high returns with an unnecessary Canada Infrastructure Bank[xxiii], when we already have one that does not require private investors in the Bank of Canada. The greatest concern of all however comes from the government’s admission, allowance, and dismissal of the obvious conflict of interest in allowing a council heavily tilted in favour of big business interests, representatives from BlackRock (the world’s largest asset manager) and McKinsey & Co., to devise the plans for the infrastructure bank that will facilitate the high returns on their investments[xxiv]. Despite the clear conflict, no disclosures were made and no one recused themselves for any of the council decisions. The government worked for months with these advisers to prepare for the closed door meeting, organized by BlackRock, between Prime Minister Trudeau and institutional investors. BlackRock even tailored and vetted the Infrastructure Minister’s presentation to ensure it was what investors wanted to hear. Furthering the conflict of interest is Michael Sabia, the president of the Caisse who wants $1.3 billion from Ottawa for light rail, leading policy discussions on the CIB as a member of Minister Morneau’s Advisory Council on Economic Growth. How are Canadians to have faith in a bank structured by the very players that will profit from it?

The manner in which the infrastructure bank was presented in legislation does little to inspire faith in it either. Following in Harper’s tradition the CIB was jammed into the undemocratic omnibus Bill C-44, which had debate stifled[xxv], and which even the Senate is considering severing into separate legislation[xxvi], as it should be for such an important change to our system. Even a KPMG report for Infrastructure Canada itself calls for caution and not to rush in before more impacts can be considered[xxvii].

With our debt as high as it is (over $1 trillion and counting[xxviii]) and inequality worsening[xxix], why would we make it worse promising above average returns and monetizing public infrastructure into a revenue stream for private investors? Even without public money creation, we can use traditional bond issues at a lower rate than investors would expect from an infrastructure bank[xxx]. The proposed infrastructure bank is a huge deviation from the Liberal election platform to “use its strong credit rating and lending authority to make it easier and more affordable for municipalities to build the projects their communities need.”[xxxi] Multiple studies from around the world have proven that using private investment to build assets, for example P3s, costs the public more money, as evidenced by Ontario’s Auditor General[xxxii] and the reversal of privatizations in Europe[xxxiii].

Are you suggesting an infrastructure bank to build infrastructure or to provide a new revenue stream for large institutional investors? How exactly are we supposed to pay back investors? Are you planning to saddle the new infrastructure with user fees so they become an ongoing revenue stream? Why do documents show the government plans to take on more risk to ensure investors get paid first, and the government last[xxxiv]? How much more debt will tax payers be on the hook for? We already made our debt worse when in February this year the BoC reduced its automatic minimum purchase of government bonds from 15% to 14%, increasing our debt burden for no apparent reason except perhaps to increase the available general collateral in overnight markets[xxxv]. Harper’s first budget in a majority cranked the rate up to 20% to suit his needs, the BoC market notice makes clear it was done “to accommodate the planned increase in government deposits held at the Bank of Canada associated with the Government of Canada’s plan announced in the June 2011 budget to increase its prudential liquidity over the next 3 fiscal years”3. Not the BoC’s plan, the Government of Canada’s plan, so why can’t we do the same? The BoC is not autonomous; the disagreement with Governor Coyne that necessitated an additional clause in the BoC Act proves that[xxxvi], as does the disagreements with Governor Crow that led to him not being renewed for another term[xxxvii].

We don't need to be a source of unearned income for investment funds, and we don't need to sell off public assets. These are capital assets for which "the cost of acquiring fixed assets is treated as expenditure at the time of acquisition"[xxxviii] instead of being depreciated over the life of the asset the way private companies can. That capital cost is also is accounted for in the same budget as the operating budget providing services, unlike municipalities’ ability to separate capital and operating expenditures[xxxix], the net effect making deficits appear worse than they are. If we really need money we’re not willing to create ourselves we should be going after the billions in tax avoidance and evasion and closing the loopholes that allow it[xl]. We don’t even attempt to measure the tax gap in Canada[xli]. Or consider raising corporate tax rates, as Canada itself has become a tax haven as evidenced by Burger King’s acquisition of Tim Horton’s[xlii], while corporations sit on billions in “dead money”, and Canada has now hit an unenviable milestone, for the first time ever getting more tax revenue from people than from businesses[xliii].

We need to provide the public with the infrastructure and services needed to ensure a high standard of living befitting a country of our wealth. Deficits are mere accounting, and recent economic studies have proven that austerity shrinks economies and deficit spending grows them[xliv]. I hope you let evidence and history, and not the specious assumptions espoused by neoliberal institutions like BlackRock, McKinsey & Co, the Chicago School, the London School of Economics, and the private banking community, guide you to the conclusion that we already have the ultimate driver of prosperity and growth: The Bank of Canada.

Thank you for your time,

Adam Smith

Toronto ON

M4L 3P7

For a full list of the research and sources used to create this letter, please visit:

https://understandingcanada.ca/wp-content/uploads/2017/07/BoC-VS-CIB.pdf