Unpublished Opinions

His 2018 Book "About Your Financial Murder..." is found on Lulu.com http://www.lulu.com/shop/http://www.lulu.com/shop/larry-elford/about-you...

Investment Misconduct and Malpractice Analyst

Larry Elford is acclaimed as a qualified expert on the subject of White Collar Crime as it relates to the investment selling industry. He is a retired CFP, (Chartered Financial Planner), a CIM, (Certified Investment Manager) by the Canadian Securities Institute, a FCSI, (Fellow of the Canadian Securities Institute), the highest designation awarded by the Canadian Securities Institute to those for top achievements in educational and industry accomplishments. He is also an Associate Portfolio Manager and Director of the Canadian Justice Review Board of Canada.

Larry worked inside the largest financial institutions in Canada for twenty years until his retirement in 2004. He works today writing, speaking and coaching Canadians on how to create safe and honest treatment for investors.

Larry Elford is also an author. He was included in John Lawrence Reynolds’ second edition bestselling book, The Naked Investor, Why Almost Everybody But You Gets Rich On Your RRSP and Bruce Livesey's 2012 book, Thieves of Bay Street, How Banks, Brokerages and the Wealthy Steal Billions from Canadians. He self-produced a documentary film, Breach of Trust, The Unique Violence of White Collar Crime, to benefit investors, legislators and those who investigate financial crime. It can be viewed on Youtube. https://youtu.be/k2K6pzFtyTU

Twitter: @RecoveredBroker

Facebook group for Fraud victims

https://www.facebook.com/groups/albertafraud/

Facebook group for Fraud victims across Canada (Small Investors Protection Association of Canada, 1998)

https://www.facebook.com/groups/240100382792373/

Video site for victims of investment malpractice

http://www.youtube.com/user/investoradvocate?feature=mhe

www.investoradvocates.ca research site

His first book is Titled "ABOUT YOUR FINANCIAL MURDER..." detailing the extent of financial abuse of the public attributable to a "self" regulated investment industry.

His second book, published in April of 2020, is "Farming Humans" and is about "How to quietly strip America bare of the truth "all men are created equal”, found in the U.S. Declaration of Independence, in less than 250 years….http://www.lulu.com/shop/larry-elford/farming-humans/paperback/product-2...

Canadians retirement security is being abused by financial institutions

Professional abuse by financial professionals and their corporations is one of the greatest unpublished threats to Canadian's retirement savings and security.

January 4th, 2016

Ralph Goodale, Public Safety Minister

House of Commons

Ottawa, Ontario K1A 0A6

Re: This is a complaint about systemic methods by which the many Provincial Securities Commissions violate and/or “exempt” Provincial Securities Act laws for the benefit of investment firms who pay the salaries of Securities Commission employees. This is costing Canadians billions of dollars each year. This has gone on for decades without attention. It is doing irreversible harm to our economy and our society.

Dear Mr. Goodale,

I write to you about an issue of abuse. Financial abuse by financial institutions which is affecting all Albertans, individuals, municipalities, Universities, retirement plans, pension funds. It also illustrates where government agencies, the various Provincial Securities Commissions, are failing in their mandate to PROTECT Canadians.

Example #1: Securities Commissions ignore public protective laws of the Securities Act at a cost to Canadians, to institutions such as the Alberta Treasury Branch, Alberta municipalities, Universities, Public Service Pension Plan of Canada etc.

Example #2: Securities Commissions routinely and regularly grant “exemptive relief” from Securities laws, with NO public notice, NO warning, nor public input into the reasons or the risks. This also has the effect of costing Canadians billions while benefitting investment product sellers.

Further to Example #1 the Commissions are wilfully blind to thousands of industry registrants who are legally registered in the capacity of “dealing representative” (formerly called salesperson’s or known as “brokers”). Thousands of such product sellers who owe no legal fiduciary duty to protect investors are flaunting Securities Act laws and calling themselves by another, separate license category. This is contrary to the Alberta Securities Act, (sec 100) Ontario Act, (sec 44) BC,(sec 34) and so on, while these agencies turn a blind eye and ignore enforcement of these laws.

This has the effect of misrepresenting a financial person who DOES NOT have to place the interests of the investor first, as someone who DOES place the interests of investor’s first. This is tantamount to a fraudulent misrepresentation and is a failure to follow Alberta Securities Act law (section 100).

This is like a person referring to themselves as a “doctor” without having the proper license, qualifications, or protective obligations (the “do no harm” oath) to the public. It is an illegal activity as well as an immoral one, and yet the ASC acts wilfully blind to this common practice which has the effect of deceiving millions of consumers and investors.

The City of Lethbridge is missing nearly $30 million dollars after taking financial “advice” from one such person, who was legally licensed as a “salesperson”, while representing himself illegally as an “advisor”. Millions of other Albertans face this same deception every day with their life savings. Hamilton Ontario took a 90 million dollar hit due to this illegality. The pension for Judges and RCMP officers (PPSP) lost $2 billion during the collapse a number of years ago.

This is akin to allowing financial firms, with the aid of regulators, to pick the pockets of Canadians on a regular and repeated basis.

I ask specifically that the government require all Securities Regulators to address, explain, correct, or be held accountable to Canadians for being unwilling or unable to protect Canadians from thousands of these misrepresentations, contrary to Provincial Securities Acts.

Example #2 is the Commissions granting “exemptive relief” (permission to NOT have to follow Securities Acts). This occurs up to 500 or more times in some years, and is done in a near-silent-to the public fashion. Members of the public are not informed when investment products they may purchase have been sold without the full protections of laws. There is usually no public notice given, nor ability for the public to be informed, to provide input, or to protest these seemingly one-sided “deals”.

Securities Commissions most-oft used statement to justify these “exemptions” to laws is just the following, “each of the decision makers, is satisfied that the conditions required to make the decision, has been met”.

This is government gobbledygook and is indicative of the arbitrary, haphazard, and reckless manner in which the fundamental protective laws of financial protection are being flaunted by Securities Commissions in Canada.

Examples include allowing banks to dump poorly performing investment under-writings (slow selling investment products) into the mutual fund holdings of bank customers, without notice to these customers, and is an appalling example of self-dealing by the banks, at harm to clients.

Other examples include allowing investments without proper ratings and safety, to be sold, which has resulted in billions of dollars being lost to consumers, investors, cities, towns, universities, pension funds and so on. These exemptions to our laws benefit the investment industry while allowing illegal, risky or unsafe products to be dumped off the books of investment sellers and onto the backs of unsuspecting consumers.

These acts of willful blindness to laws, and secret permissions to allow intentional violations of laws are contrary to the protective intentions of the Securities Commissions, and I again ask to be investigated thoroughly, by a full review of these agencies, and the proper changes put in place to ensure professional, and ethical protection of Canadian’s life savings. I would also like to be allowed to present information and answer questions of any government review of agencies such as the Securities Commissions.

Larry Elford, Lethbridge AB

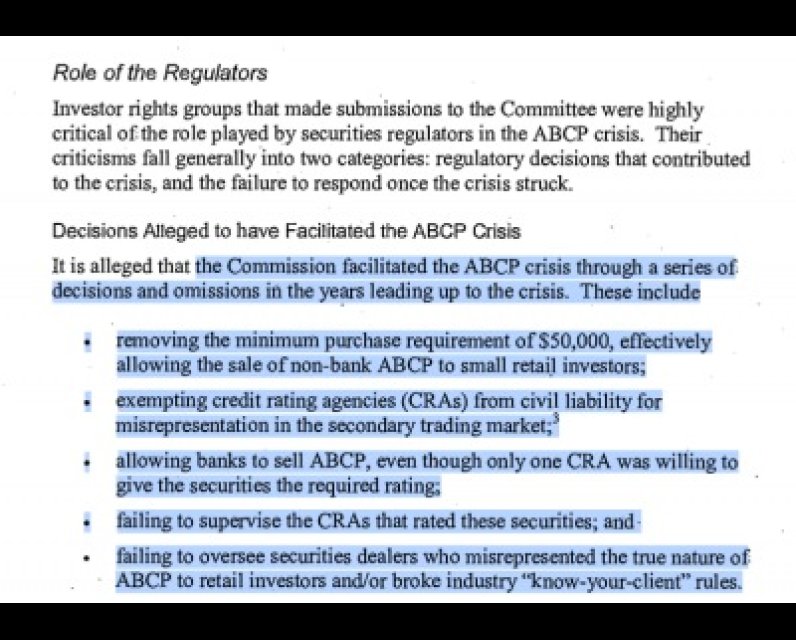

The following captured image (from an Ontario Government report into the Ontario Securities Commission (2011?) is illustrative of how provincial Securities Commissions in Canada fail in their public protective functions and cost the country billions. The loss to Canada (and gain to those the OSC, ASC etc., regulate) was in the neighbourhood of $35 billion dollars and is considered to be Canada’s largest financial crime/loss to date.

It must be pointed out, that in addition to the points listed below, that provincial Securities Commissions actually granted “exemption from the law” to allow these “investments” to be sold to Canadians. They did this, as always, in semi-secrecy, with no warning to investors or to the public. Just who does the provincial regulator serve? It is NOT protecting the public.

letter and images linked here http://www.investoradvocates.ca/viewtopic.php?f=1&t=184

Comments

Be the first to comment