Unpublished Opinions

His 2018 Book "About Your Financial Murder..." is found on Lulu.com http://www.lulu.com/shop/http://www.lulu.com/shop/larry-elford/about-you...

Investment Misconduct and Malpractice Analyst

Larry Elford is acclaimed as a qualified expert on the subject of White Collar Crime as it relates to the investment selling industry. He is a retired CFP, (Chartered Financial Planner), a CIM, (Certified Investment Manager) by the Canadian Securities Institute, a FCSI, (Fellow of the Canadian Securities Institute), the highest designation awarded by the Canadian Securities Institute to those for top achievements in educational and industry accomplishments. He is also an Associate Portfolio Manager and Director of the Canadian Justice Review Board of Canada.

Larry worked inside the largest financial institutions in Canada for twenty years until his retirement in 2004. He works today writing, speaking and coaching Canadians on how to create safe and honest treatment for investors.

Larry Elford is also an author. He was included in John Lawrence Reynolds’ second edition bestselling book, The Naked Investor, Why Almost Everybody But You Gets Rich On Your RRSP and Bruce Livesey's 2012 book, Thieves of Bay Street, How Banks, Brokerages and the Wealthy Steal Billions from Canadians. He self-produced a documentary film, Breach of Trust, The Unique Violence of White Collar Crime, to benefit investors, legislators and those who investigate financial crime. It can be viewed on Youtube. https://youtu.be/k2K6pzFtyTU

Twitter: @RecoveredBroker

Facebook group for Fraud victims

https://www.facebook.com/groups/albertafraud/

Facebook group for Fraud victims across Canada (Small Investors Protection Association of Canada, 1998)

https://www.facebook.com/groups/240100382792373/

Video site for victims of investment malpractice

http://www.youtube.com/user/investoradvocate?feature=mhe

www.investoradvocates.ca research site

His first book is Titled "ABOUT YOUR FINANCIAL MURDER..." detailing the extent of financial abuse of the public attributable to a "self" regulated investment industry.

His second book, published in April of 2020, is "Farming Humans" and is about "How to quietly strip America bare of the truth "all men are created equal”, found in the U.S. Declaration of Independence, in less than 250 years….http://www.lulu.com/shop/larry-elford/farming-humans/paperback/product-2...

Big Box Lies -- Investment Salespeople in Disguise

This letter is part of an ongoing campaing of public awareness, to inform and to promote fairness and transparency in financial matters affecting millions of Canadians. It is shared in the hopes that those who find it valuable, will also share it with others, and that the social fabric of our communities can become stronger as a result. The author is a 30 year veteran of the financial industry, and works today to help others by passing along what he has learned. The following video from Cary List of the Financial Planning Standards Council of Canada speaks to part of this issue in the first 40 seconds.

BIG BOX LIES…

INVESTMENT SALESPEOPLE IN DISGUISE

A few years back there were several big box electronics stores in my area. After a time it became known that one of those stores was keeping a couple of secrets from its customers.

The first secret was that all their salespeople were on a commission, and they had hidden incentives to sell things that were more expensive (or more profitable to them) than necessary.

The second secret, was that the retailer was known for buying up boatloads of last year’s electronics models, and NOT telling customers that they might be looking at an older model.

The first secret, led to other, more ethical retailers to start a campaign that said, “all our staff are non-commission”. “We are here to help you to get the best product at the best price”.

This same game of secrets is taking place with the retirement and investment savings of tens of millions of North Americans. See what Barrack Obama says about this here https://youtu.be/GQXJx23acxY

In Canada we are silent for polite Canadian reasons,...and some not so polite reasons.

In the investment industry 99% of salespeople (aka “advisors”) are also on commission, and they often find that their dealers have some poor investment products to sell. (to unload)

(see the movie THE BIG SHORT for just ONE of the examples, while a hundred other tricks of the investment selling trade are found here: http://www.investoradvocates.ca/viewforum.php?f=1 )

In contrast there ARE financial professionals (search FIDUCIARY ) who charge a fee specifically to NOT take advantage of the customer, and to serve them as one would expect a professional like a Doctor is required to do. This brings a legal duty to work solely in the interests of the investor, and none other. Sadly, this is also the impled promise of 99% of commission investment salespersons, so consumers are confused, as well as potentially abused.

This link quickly shows how a former TD Bank CEO and Tony Robbins describe those two roles https://youtu.be/23xWWsGp6vU

It is quite a surprise in what truth the banker carelessly reveals in the first 2 minutes.

The trouble is NOT that there are “salespeople” in the investment products business.

The trouble is that 99% of those on commission, (aka broker, registered rep, salesperson, “advisor”) are HIDING THIS FROM CUSTOMERS, just like the electronics store did.

“Advisors” in Canada cleverly conceal the four most important items from customers:

1. They conceal their exact LICENSE or REGISTRATION category. They will call themselves instead by a non-regulated "title", usually one that sounds amazingly close to what a professional would use, or attempts to "mimic" what is in actual law (legislation).

Lawyers (and securities regulators) will tell you this "title" is not the legal word used in the Securities Act. (The legally followed word is “Adviser”, spelled with "er" at the end) While you might be using the dictionary, or worse, the Globe and Mail, to get your definition of "advisor", the investment industry is doing a bait and switch with the law. (Lawyers, huh?)

Unbelievable? Canadian Securities regulators have admitted that this is the case, and FINRA in the USA has placed hints on their website, but no, they are not yet telling the general public… https://youtu.be/xoLiM40SD7k

2. They cleverly conceal the AGENCY DUTY of their license (to whom do they owe a loyalty to , the client, or their dealer? Real Estate agents MUST disclose to whom they owe an agency duty to, every time. “Advisors”?…NEVER.

See Dual Agency is "Bait and Switch." at http://www.caare.org/content/dual-agency-ultimate-bait-and-switch

3. They hide their true role as commission salespersons. Concealment is deception. Deception is fraud.

4. They hide the commission incentives of their dealer, which cause most (70%) salespersons to sell less than stellar investments, for up to ten or twenty times more money, in some cases (see SUITABILITY as a loophole here) https://youtu.be/aWulI3Kwi_A

They conceal these important things because deceiving the public is essential in being able to better earn the investors trust. Trust, is the secret ingredient that prompts investors to give their money to any “advisor”. Deception is a form of robbery, and trust is the weapon used.

The retail investment industry chooses to misinform you, to more readily gain your trust……..oh, the irony.

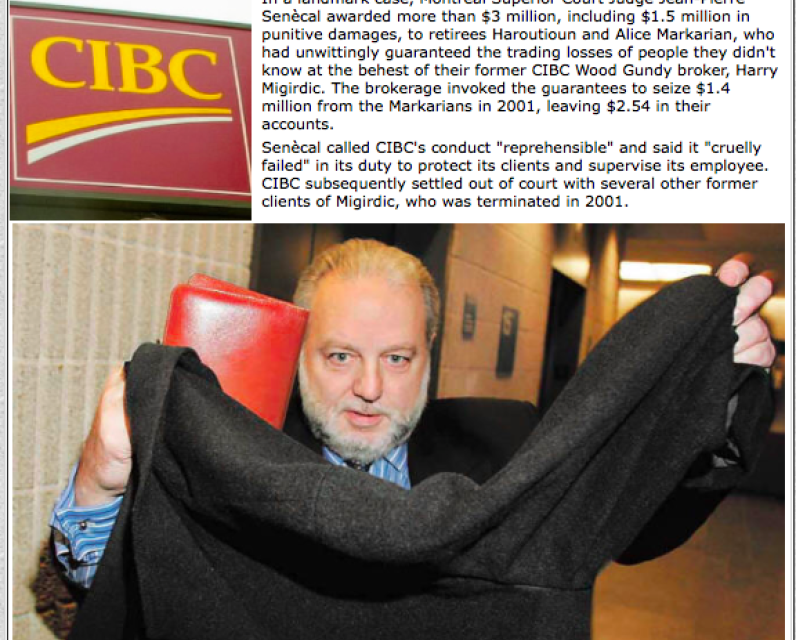

At this link a Judge rules about using false titles to fool and deceive investors. He is referring to big bank (CIBC in this case) propensity to use "fake titles" such as Vice President, etc to more easily "lure customers into a false sense of security" and to reduce their distrust. But keep in mind, that it was not until 2013 or later that Stan Buell of the Small Investor Protection Association (www.sipa.ca) and myself stumbled upon what we today call the greatest deception in our collective 50-60 years of investment experiences.

This Quebec Superior Court Judge uses the word “fraud” 155 times in a case involving CIBC, when referring to other fakery that retail investment salespeople use to lure customers.

. http://investorvoice.ca/Cases/Investor/ ... _index.htm

Canadian Securities regulators (and self regulators), are all paid from the investment industry. They should be telling investors this, as should U.S. regulators like the SEC, FINRA, SIFMA. But they choose not to rock the boat, and remain silent instead. Job security and "system" loyalty takes precedent in this grand consumer deception.

In Canada there is even a new initiative, called the Client Relationship Model (version 2) (CRM2 is the acronym). In this new and improved disclosure process, they have still failed to come clean on the secrets above. (imagine a "relationship disclosure policy" which hides the most important elements necessary to the customer being able to understand the relationship.)

Some call it “CRIME 2”, since it is a crime to allow consumers to be deceived so completely by people who could just as ethically be selling old model electronics. Please let your politician know this financial trickery is unacceptable in our country and that self regulation, with 100% "industry members" doing the "regulating" nothing more than gang rule by gang members. (Video titled WINNER STEAL ALL looks at financial regualtors allow looting like an LA riot: https://youtu.be/EyAuod1QxhQ

Also visit the flogg topic titled Advisor Disguise/Deception at http://www.investoradvocates.ca

If you wish to join a social media group that warns, educates and discusses systemic financial abuse by financial professionals, please join at https://www.facebook.com/groups/albertafraud/

(this group has expanded to encompass Canadian and U.S. SYSTEMIC financial abuses by financial professionals)

or https://www.facebook.com/groups/240100382792373/ Small Investor Protection Association of Canada, established 1998, and the source of the most honest investment information in Canada.

Twitter users can follow along @RecoveredBroker

Join the growing parade of investors and ethical investment professionals who seek to escape the “bait and switch”, of commission salespersons, and find true ethical professionals and best practices for your life savings.

Read the entire court case judgement Markarian v CIBC here http://investorvoice.ca/Cases/Investor/ ... _index.htm

Comments

Be the first to comment