Unpublished Opinions

His 2018 Book "About Your Financial Murder..." is found on Lulu.com http://www.lulu.com/shop/http://www.lulu.com/shop/larry-elford/about-you...

Investment Misconduct and Malpractice Analyst

Larry Elford is acclaimed as a qualified expert on the subject of White Collar Crime as it relates to the investment selling industry. He is a retired CFP, (Chartered Financial Planner), a CIM, (Certified Investment Manager) by the Canadian Securities Institute, a FCSI, (Fellow of the Canadian Securities Institute), the highest designation awarded by the Canadian Securities Institute to those for top achievements in educational and industry accomplishments. He is also an Associate Portfolio Manager and Director of the Canadian Justice Review Board of Canada.

Larry worked inside the largest financial institutions in Canada for twenty years until his retirement in 2004. He works today writing, speaking and coaching Canadians on how to create safe and honest treatment for investors.

Larry Elford is also an author. He was included in John Lawrence Reynolds’ second edition bestselling book, The Naked Investor, Why Almost Everybody But You Gets Rich On Your RRSP and Bruce Livesey's 2012 book, Thieves of Bay Street, How Banks, Brokerages and the Wealthy Steal Billions from Canadians. He self-produced a documentary film, Breach of Trust, The Unique Violence of White Collar Crime, to benefit investors, legislators and those who investigate financial crime. It can be viewed on Youtube. https://youtu.be/k2K6pzFtyTU

Twitter: @RecoveredBroker

Facebook group for Fraud victims

https://www.facebook.com/groups/albertafraud/

Facebook group for Fraud victims across Canada (Small Investors Protection Association of Canada, 1998)

https://www.facebook.com/groups/240100382792373/

Video site for victims of investment malpractice

http://www.youtube.com/user/investoradvocate?feature=mhe

www.investoradvocates.ca research site

His first book is Titled "ABOUT YOUR FINANCIAL MURDER..." detailing the extent of financial abuse of the public attributable to a "self" regulated investment industry.

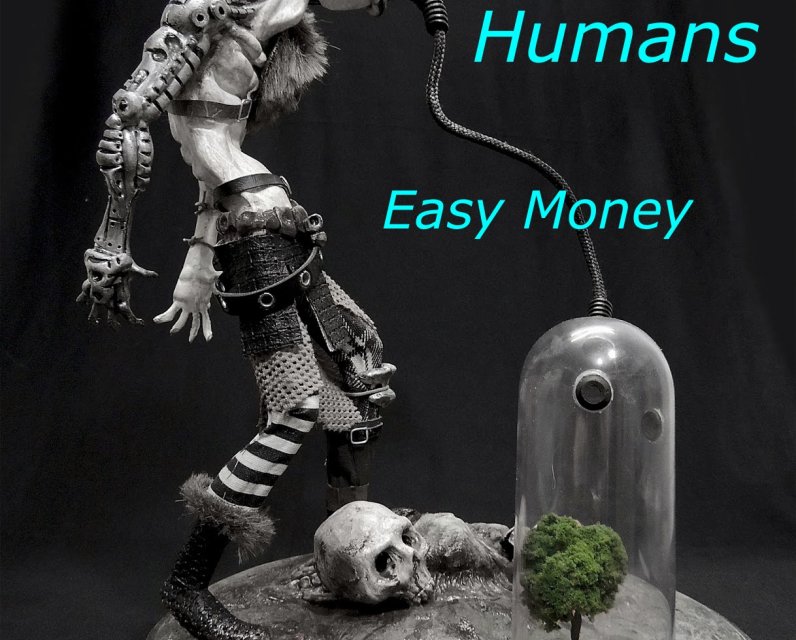

His second book, published in April of 2020, is "Farming Humans" and is about "How to quietly strip America bare of the truth "all men are created equal”, found in the U.S. Declaration of Independence, in less than 250 years….http://www.lulu.com/shop/larry-elford/farming-humans/paperback/product-2...

Farming Humans

While attempting to put together the million piece puzzle that is Organized Financial Crime by Organized Professionals, I ran across the following stories that seemed to connect and belong in the picture. I hope you find them of interest. They impact your life savings and your family's financial security.

The exemptions to Securities law in one case alone allowed Trans Mountain Pipeline, Kinder Morgan Canada Ltd, to conceal 12 essential financial reporting documents prior to being offered for sale to the Canadian government. Interesting.

The concept that industry-paid investment regulators are secretly engaged in selling passes to "exempt" the law, is of even greater interest.

A pre-Covid-19 authored, mid-Covid-19 released book is available at Lulu.com or Amazon with a couple different cover-art images. To the left is the image at LuLu.com (search Farming Humans Larry Elford) or visit https://www.lulu.com/en/us/shop/larry-elford/farming-humans/paperback/pr...

Farming Humans is: “Wealth of Nations” meets “Animal Farm”…A blend of Adam Smith and George Orwell explains how we arrived at our 2020 society.

==========

The largest news story in Canada, in 2012 was about a failed meat inspection regulatory process at a meat packing plant in Brooks, Alberta

Inside the story were details of a two-tier inspection process, one level of due diligence for meat for shipment to Japan or other buyers, and a less rigorous inspection process for meat being shipped for sale in Canada and the U.S.

Imagine if hidden regulatory “levels” of safety were allowed in Canada and the U.S., in the food you are consuming, with just a wee-bit of e-coli, and a bit of dying allowed, for North Americans? Now imagine something like that in your financial diet, your investments and your life savings. If it sounds like part of a well organized system of financial murder, then I believe you may be on the right track.

===============

What if I told you of financial regulatory systems where investment product sellers, could have rules and laws ignored thousands of times each year, simply by paying the salaries of the so-called “regulators”? What if the use, influence, purchase or capture of provincially, Federally, (perhaps State and SEC) regulated securities regulators looked like a racket, a bribery scheme, a game of pay the regulator to capture the regulator, and reap the benefits of owning a government empowered regulator. If none of the above are observable, try simple “Quid Pro Quo”. It is the most valuable, least traceable currency in this professional, political organized crime game.

What if that could be seen as a criminal breach of the public trust….if there were ever anyone looking?

What if it only takes a handful of millions of dollars to own and control an entire regulatory body?

What if the profit, the unjust enrichment, the harm to the public, which is to say, the profit to those buyers of our government regulators can reap tens of billions of dollars each year on their "investment" into our government legislated “regulators”?

Trans Mountain Pipeline

Valeant Pharmaceutical (Market Cap loss of about $70 billion)

Bank of Montreal

RBC

TD

National Bank Investments

O’Leary Fund Management LP

CIBC

Bombadier

Kinder Morgan

Un-rated Sub-Prime Mortgage Investments (ABCP) ($32 Billion lost)

Faked "portfolio managers"

Thousands of others, on the public record, but hidden cleverly enough to ensure none ever know.

==========

What if Canadian (and American) retail investors are being given a similar kind of tainted, toxic, or e-coli-like products, not simply in their food products as seen in the 2012 news story, but every day since then, in silence, in their investments?

==========

What if a single case of exemptive relief to securities laws, rules, practices could do a financial harm to markets or economies...of amounts equal to millions and millions of ordinary street crimes? And no police, prosecutor or investigator will ever be involved?

(Avergage property crime in Canada is $5000 per property crime) Securities law exemptions generate profits into the billions.

==========

In 2007, Kinder Morgan reported to the National Energy Board that it valued the Trans Mountain pipeline system at $550 million. Here is the Ontario Securities Commission granting them permission to conceal "material" information to prospective buyers in 2018: https://www.osc.gov.on.ca/en/SecuritiesLaw_ord_20180329_215_kinder.htm

==============

"Let’s repeat that fact: the federal government will pay $4.5 billion for an old and compromised tanker and pipeline system that the company valued at $550 million in 2007."

“The federal government have overpaid for an aging asset that has huge integrity problems. Every year they have to spend more on maintenance to keep it running,” added Allan. From: https://thetyee.ca/Opinion/2018/05/29/Canada-Dirty-Pipeline-Bailout/?utm...

============

Why can private interests purchase a pass to violate our laws, endangering the public, and no notice, public input, public warning or involvement is permitted?

Could you approach a law enforcement agency and purchase an exemption from speeding or traffic laws, allowing you to drive your vehicle at 125 mph on the 401 with complete impunity? Private financial entities easily do the financial equivalent of this type of practice. it occurs all the time without public knowledge.

It is almost as if a “deferred prosecution agreement” (DPA) can be purchased, IN ADVANCE of committing an intended violation of the law, to make it even easier than having the legal muss and fuss of being caught, and having to then fight for a DPA.

Simply fund the government legislated “regulators”, and tell them what you wish them to do, (or not do) to “regulate”.

I am certain that you will disbelieve this concept as ludicrous, and this is why I enclose a PDF copy below, of one such exemption granted to Trans Mountain/kinder Morgan in advance of to its eventual sale to the government. It is almost as if the company knew what information needed to be kept hidden, and obtained permission "exemptive relief" in advance so they could dupe the eventual purchasers.

https://www.lulu.com/en/us/shop/larry-elford/farming-humans/paperback/pr...

PDF attached below for TransMountain

Comments

Be the first to comment